Since we discussed your different home loan choice, let’s see how such choice compare with the doctor Mortgage loan

- Just for Number 1 Quarters – Since Virtual assistant mortgage, this option merely allows you to utilize this financing on your primary home. If you’re buying an investment property, try looking at different kinds of mortgage loans!

Now that i discussed your other home loan choices, let’s see how such choice compare to a doctor Mortgage

- Lives Home loan Insurance rates – Even though you can buy a property that have a low downpayment through this choice, possible be caught which have home loan insurance coverage (PMI) for the entire life of the borrowed funds. One method to stop it is to refinance towards the an entirely some other financing types of.

As the identity ways, this type of financial is excellent when you find yourself an initial time domestic consumer. Area of the difference between so it loan and FHA loan is actually this particular sorts of demands that become a first-date household buyer. Hence, it offers straight down borrowing from the bank and you can downpayment requirements. Certain states, also Colorado, provide gives to brand new homeowners whom could well be incapable of rescue extreme advance payment.

Given that i talked about the various other mortgage choice, let us observe this type of choice compare to the physician Home mortgage

- Grants – The newest gives from this style of mortgage can assist towards will cost you of shopping for very first home, plus off money and you will closing costs. New HomePath Able Buyer exists because of the Federal national mortgage association and can pay out to three% of one’s mortgage’s settlement costs.

Now that i talked about your additional financial solutions, why don’t we observe how such selection compare to the physician Real estate loan

- Notice Subsidies – Certain groups help straight down-money borrowers get a diminished speed, leading to down monthly payments.

Since i talked about their additional financial selection, let’s see how this type of possibilities compare to a doctor Mortgage

- Earnings Limits – As opposed to new FHA funds, first time home consumer loans limit the buck number of property that you can buy.

Since we chatted about your different mortgage solutions, let us see how these types of possibilities compare with the doctor Home mortgage

- Just for a primary Quarters – Such as FHA and you can Va financing, these types of mortgage is only meant for a primary house, which makes it a negative selection for real estate traders. Banking institutions also provide stipulations on what kind of household will meet the requirements for this mortgage. Such as for example, certain banking companies wouldn’t offer an initial-time home visitors mortgage to possess property consider a flat.

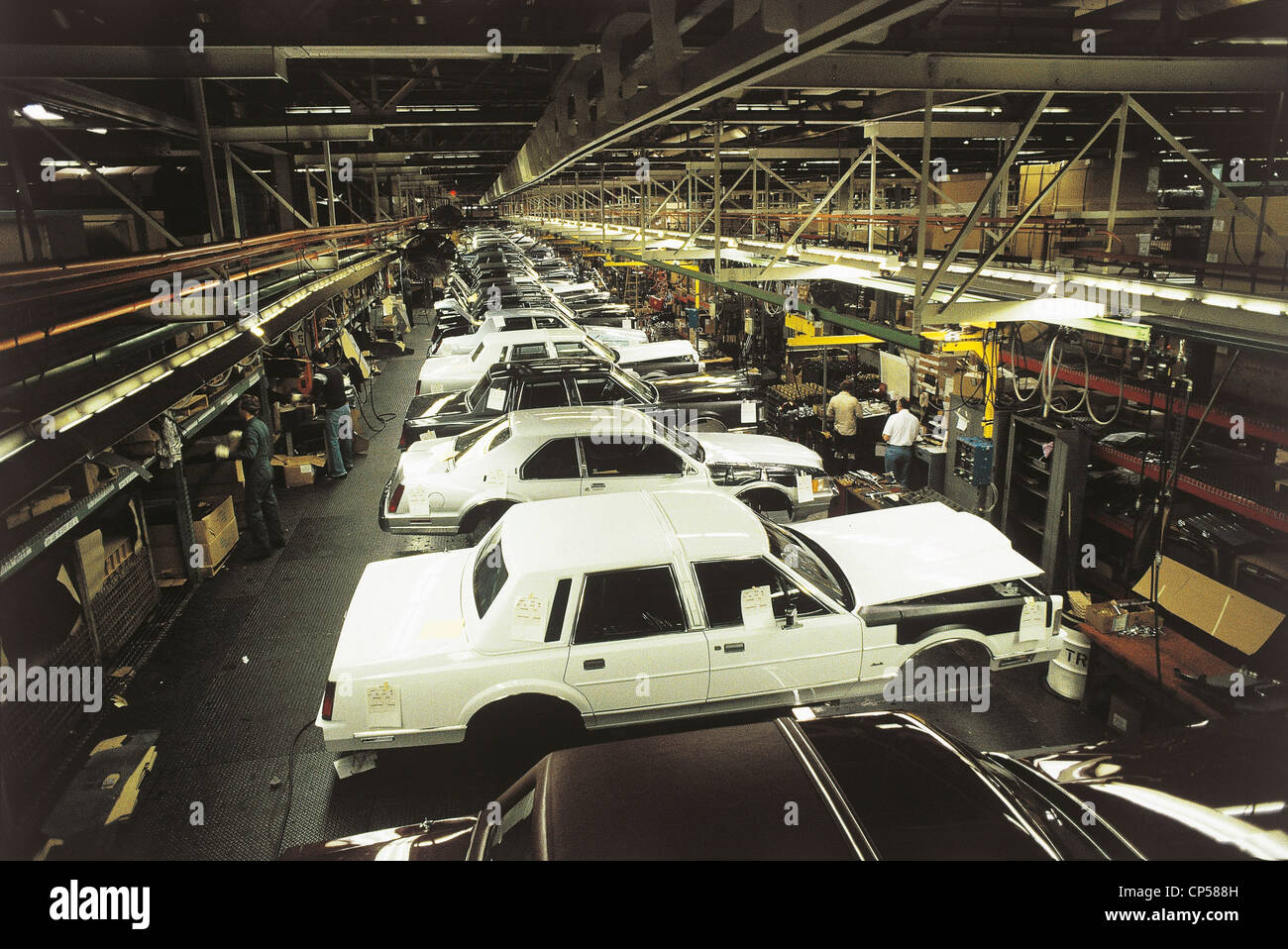

Medical practitioner mortgage loans are designed for doctors, exactly who often have highest personal debt so you’re able to income percentages. This type of finance help doctors and dentists feel homeowners since they possess lower down payment conditions and can appeal to owners as well as payday loans Mead the the fresh students. These experts normally qualify for such financing while they only have to features a health degree and you can defined begin time for their jobs.

Given that i discussed the various other home loan options, let us see how such solutions compare to the physician Mortgage loan

- Lower Advance payment – That is one of the best type of mortgages if you may have restricted fund to possess a down-payment as you possibly can lay only 0-10% off rather than PMI.

Given that i chatted about your more financial possibilities, why don’t we see how this type of choice compare to the doctor Real estate loan

- Short Closing Procedure – For those who have an agreement for future work, then this might be adequate. Other different kinds of mortgages require that you be currently performing.

Given that we talked about your own different financial possibilities, let us find out how these selection compare to the physician Real estate loan

- Stricter Borrowing Requirements – To locate a doctor financial, you must have a credit score around 700. Certain loan providers can go as little as 680, while some need a great 720 FICO get.

Given that we talked about your own additional home loan choice, why don’t we observe how such options compare to the doctor Home loan

- High Charge – The brand new fees and you can rates try greater than a fundamental financing. Financial institutions tack within these even more costs since this home loan system allows one have a reduced deposit rather than PMI.

Overall, an informed particular home loan for your next home get may differ greatly on your situation. Uncertain which one best suits your position? Apply at a economic gurus to begin with believed aside your residence get package away from a financial angle!

Comentarios recientes