- An enormous deposit: Of numerous loan providers will demand an advance payment of 20%, although it are you are able to to place off merely ten%. If you would like set-out a tiny deposit, your own borrowing from payday loans Meadowbrook the bank, earnings and money reserves might need to be even higher.

Loan providers were selective for the borrowers it accept to have jumbo financing, if you want to make sure your meet the requirements, you can also focus on accumulating their borrowing and you can assets.

Good jumbo home loan is not designed for someone to buy significantly more household than just they are able to reasonably pay for. Jumbo mortgages are for these homebuyers who will be financially safe and you may are interested a property that’s costly compared to mediocre possessions. Searching up the limits on the compliant finance in your city to choose in case the fantasy household is higher than new maximum, and in case it does, you can even look into obtaining a beneficial jumbo financial.

Jumbo mortgages should be just the thing for younger professionals beginning in the its careers that are making a high paycheck, but whom maybe don’t possess significant info gathered just yet. When you’re a top-money earner and work out $250,000 so you’re able to $five hundred,000 annually, and you are thinking of buying a pricey domestic, a beneficial jumbo mortgage would-be an effective choice for you.

What is actually a compliant Loan?

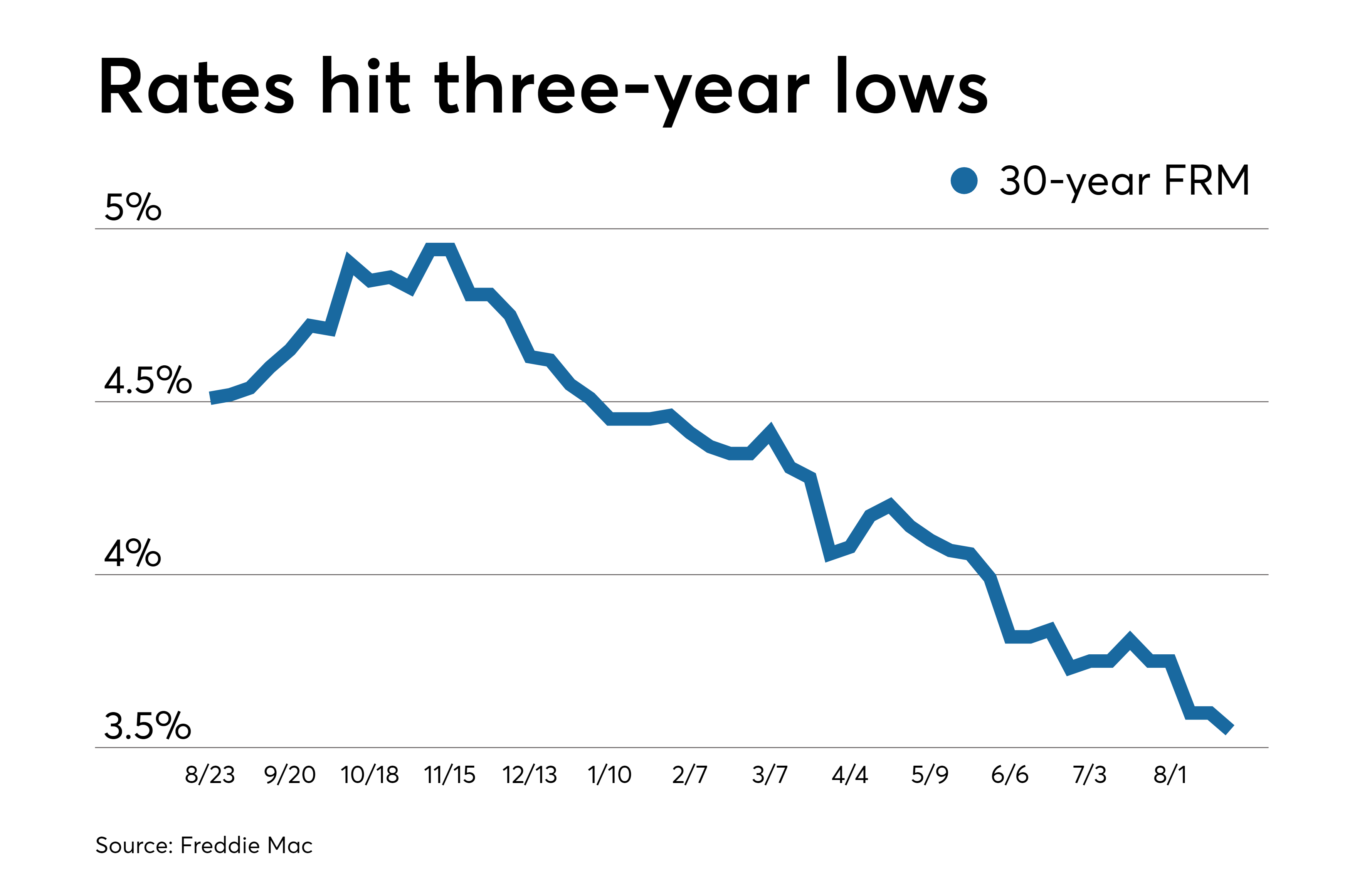

Conforming funds get their label as they follow the brand new details set by Freddie Mac computer and you will Fannie mae. Financing terms and conditions become sensible, cost and you will qualifications having compliant financing was standard, and you will interest levels would be less than low-compliant money. A conforming mortgage is also entitled a traditional mortgage that’s the most famous kind of home loan.

step 1. Why does a conforming Mortgage Performs?

Given that compliant finance realize Federal national mortgage association and you will Freddie Mac computer assistance, he could be extensively accepted by loan providers and mortgage issuers. Financing one to follow criteria are easier to promote and get.

What most of the compliant loans have as a common factor try their needs to have an advance payment, credit history, loan restriction and obligations-to-earnings proportion. Compliant fund are not backed by authorities firms, thus FHA funds, USDA loans and you may Va loans commonly believed conforming finance, since they’re the supported by government entities.

Compliant mortgages include loan restrictions. For just one-product properties, the fresh new 2019 maximum was $484,350 in the most common of the nation, but when you look at the areas that have competitive property areas, hence, large home values. Regardless of, discover however a cap having aggressive locations, that is 150% more than the base limit. Already, so it sheer limitation is actually $726,525.

The degree of desire possible spend on the conforming mortgage is based to the interest your acquire and the length of the mortgage title. Such as, you might choose from a 30-year or 15-year home loan. For a thirty-seasons home loan, it is possible to shell out significantly more notice, your monthly premiums will in addition be lower than having an effective 15-year home loan.

If you cannot lay at the very least 20% off, you will probably have to pay individual home loan insurance premiums. PMI handles the lender if you’re unable to build your home loan repayments, however, which insurance will not protect you, the new debtor.

dos. Would you Refinance a good Jumbo Mortgage For the a conforming Financing?

If you’ve protected an excellent jumbo mortgage, you will be wondering whenever you can re-finance the loan toward a conforming home loan. Though it is possible, refinancing would be a problem. According to your position, it can be worth the effort when it function larger discounts by removing their monthly premiums and your interest rate.

- A beneficial FICO score with a minimum of 660

- A financial obligation-to-income proportion less than 43%

Comentarios recientes