The home should be free of defective framework otherwise rust. Brand new Virtual assistant appraiser usually search the home to have eg affairs, in addition to proof one wood-destroying bugs. Infestations, such as termites, can cause expensive and you will risky problems for the origin away from an excellent family.

Lead-situated paint

If you are searching during the property established ahead of 1978, there is a good chance the newest appraiser often demand color solutions. The reason being the appraiser have to believe that a house off it ages keeps lead-centered color. One paint defects such as for example chipping or peeling need to be fixed, because this is a lead poisoning threat.

It is quite common to have elderly property getting reduced-than-prime parts of the outside otherwise interior paint. Luckily, that isn’t an emotional otherwise expensive repair. advance america tax refund loan In case your bad part of color is not all that large, a painting company could abrasion, primary, and you can re also-painting the room rapidly and you will inexpensively.

Although not, there was a go your surface itself has deteriorated. In such a case, brand new exterior otherwise indoor wallboard must be replaced, in addition to the color. This might get more high priced.

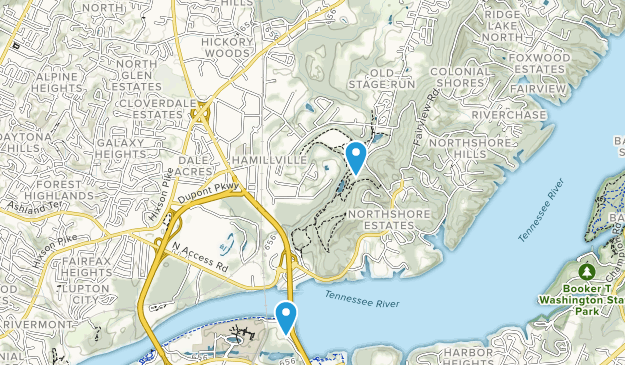

Precise location of the house

Taking care of out-of a house that a seasoned will most likely not thought throughout the prior to making an offer is the geographic location and you may the nearby functions. Should your home is found on a petrol otherwise petroleum pipeline easement, it may not qualified to receive Virtual assistant money. The easement ‘s the city close the latest tube, a buffer getting electric teams to get into and work on the tube.

In the event the household structure is contained in this 220 meters on the often area of the tube (the newest pipeline by itself, perhaps not the fresh easement), a page must be authored by the fresh new pipeline company proclaiming that the new pipeline are certified with specific rules.

Additionally, you will find limitations against the household getting as well next to highest-voltage electronic traces. The structure otherwise outbuildings may not be inside the electric range easement (buffer area). This laws does not consider practical street strength contours, however, high, high-voltage indication contours.

Are built land

Are made residential property need meet the important MPRs away from practical residential property, with more requirements. Your house must be permanently connected so you’re able to a foundation that’s sufficient with the stream of the home. On top of that, are designed house in some geographical metropolises might require unique links and you may bindings to withstand hurricanes and earthquakes.

Very are built property will need long lasting skirting, that’s an ongoing metal or wood housing inside the basis. Likewise, really are created homes you would like a vapor barrier, that’s only a continuous synthetic layer across the unwrapped environment or dirt in the examine area.

Just who will pay for repairs?

If fixes are expected, such color repair, roof fix, etcetera., its top in the event your supplier helps to make the fixes during the their or her very own costs prior to closure. If the supplier doesn’t have money accomplish the brand new repairs, probably the real estate agents in it will find an approach to result in the fixes. When there is absolutely no way to complete this new fixes, and are generally required to receive Va investment, you may have to right back out from the price and find a much better household.

This isn’t a good idea into the veteran to pay for repairs away from his very own pouch ahead of closing. Say, by way of example, you pay $5000 from inside the fixes, and your financing is refuted in some way. You just invested a fortune fixing up somebody else’s household.

Neither is it advisable to accept pledges on provider so you can create repairs after closure. For just one, your financial cannot romantic the mortgage in case your household provides Virtual assistant deficiencies. Second, all wagers was of because the loan shuts. The vendor will not have one focus to help make the solutions within the period.

Comentarios recientes