Although not, when you’re alert to new prepayment penalty and you can factoring it to the your choice, you can prevent one surprises later on.

Settlement costs

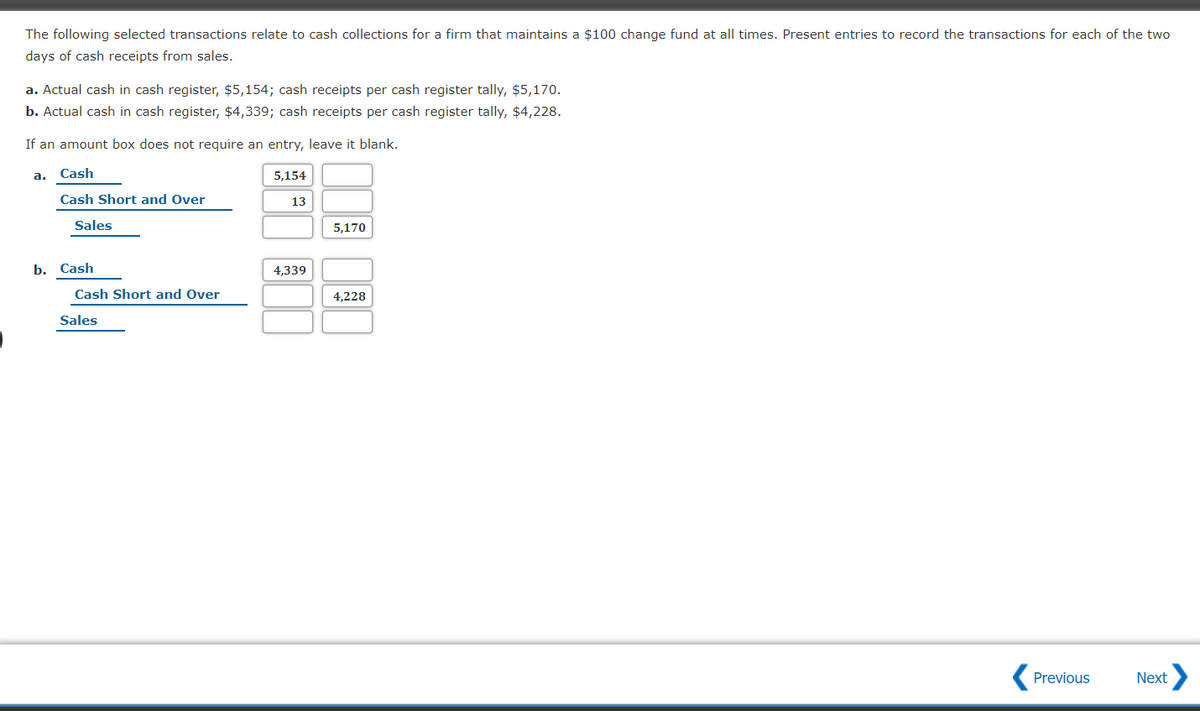

Settlement costs are charges that will be recharged by lender so you’re able to techniques and personal a house security mortgage. Such can cost you range from assessment fees, attorneys costs, name look costs, and you can tape costs. The total cost of settlement costs may differ with respect to the lender, the borrowed funds count, and also the precise location of the assets. Although not, closing costs can generally speaking range from 2% in order to 5% of amount borrowed.

- Higher initial will cost you: Closing costs are going to be a life threatening upfront debts, particularly for consumers that are currently not able to make ends meet. Such can cost you causes it to be difficult to pay for property equity mortgage, even when the interest try lower.

- Placed into the loan number: Closing costs are usually placed into the loan number, for example you may be paying interest in these will cost you across the life of the mortgage. This will boost the total cost of one’s loan by the various otherwise several thousand dollars.

- Are going to be difficult to discuss: Settlement costs are typically low-negotiable, for example you might not be able to lose such will set you back. This means that, it is essential to grounds settlement costs into the finances whenever considering taking out a home guarantee loan.

Closing costs is a significant disadvantage from house security loans. By being aware of these will cost you and you will factoring all of them into your decision, you could prevent one unexpected situations afterwards.

Effect on credit history

Domestic guarantee finance may have a negative influence on your borrowing score, which can make they much harder in order to be eligible for other types out-of financing down the road. There are a few reasons for having which. First, when you take out a house collateral financing, the financial institution will make a painful query in your credit file. This can decrease your credit rating by the several activities. Second, domestic equity financing are usually shielded by your family, meaning that for individuals who standard toward loan, the lending company could foreclose in your domestic. This will together with ruin your credit score.

- Less credit rating: Taking out fully a home collateral mortgage is also reduce your credit rating, which can make they more difficult so you’re able to qualify for other designs regarding funds subsequently, such as a home loan otherwise a car loan.

- Issue being qualified for financing: A lower life expectancy credit score helps it be more difficult to help you be considered having money, or if you may only be able to qualify for fund that have highest rates of interest.

- Large interest rates: If you do qualify for a loan which have a lower credit score, you will be recharged increased interest rate, that may improve the cost of the mortgage.

If you’re considering taking right out a house security loan, it is critical to know the prospective effect on your credit rating. It’s also wise to comparison shop and you may examine rates of multiple lenders to get the best it is possible to contract.

Might not be taxation-allowable

Of a lot home owners overlook a button outline when it comes to property security loan: income tax deductibility. Rather than traditional mortgages, the eye to the home collateral loans is income tax-allowable in case the financing can be used so you’re able to purchase, make or dramatically raise your residence. As a result if you are using the loan to help you combine loans, pay for university, otherwise shelter almost every other costs, the attention are not tax-allowable.

- Affect monthly payments: The https://availableloan.net/loans/no-phone-calls-payday-loans/ fresh new tax deductibility of family security loans can have a life threatening influence on the monthly premiums. While you are capable subtract the eye on the loan, your own just after-tax cost of borrowing from the bank would-be down. This can save a lot of money on a yearly basis.

Comentarios recientes