Home ownership is sold with an abundance of freedom. Instead of leasing, you are able to select everything about your house. not, whenever owning a home, you happen to be totally responsible for the fix and you may solutions. Used, you are your own property manager, administration organization and you will repairs class all in one. In the event of an urgent situation house resolve, so it obligation can get easily be challenging. However with some preparing and also the proper education within the your back pocket, funding emergency home fixes could easily go from utterly challenging so you’re able to outright manageable.

Get yourself ready for household repairs

Just like the a resident, upkeep is part of the job. Later on, your home often mature and need repair. This can consist of difficulties with fittings and you can products, to full architectural solutions eg a threshold substitute for. In the event your property is an excellent fixer-upper or an alternate create, some of the most preferred (and regularly pricey) disaster household solutions vary from:

Roof leaks otherwise rooftop ruin

A ceiling fix could cost from a few hundred in order to several thousand dollars, with the federal mediocre getting around $step one,000 . In the event your wreck can not be fixed, needed a ceiling substitute for. (The new federal mediocre to possess roof substitute for is $eleven,000, however, can cost you may differ generally predicated on factors.)

Plumbing work factors

Plumbing work affairs will be one thing ranging from leaking faucets and blocked sinks in order to backed-upwards sewage or bust pipelines. Any of these situations was small and may also getting repaired with an easy check out from your own the optimum time, while recognized-right up sewage will likely be major house surgery costing on average $4,000 .

Electronic facts

The same as plumbing, electric issues cover anything from lesser repairs such as an excellent blown fuse to help you crisis fixes getting wrong wiring otherwise inundated circuits. If you feel an energy outage otherwise dangerous electricity spikes causing shocks or damaged equipment, it good reasons for an emergency fix. Can cost you hinges on how big is your property and also the the quantity of your fix. The federal mediocre to own complete rewiring generally incurs brand new plenty.

Hvac assistance

Cooling and heating means to suit your home’s heat, ventilation and you may air conditioning system. In the event the Cooling and heating goes out while in the high climate, which ple, if you live into the a location which have severe winters along with your home heating system breaks down just before an effective snowstorm, it’s also possible to fairly regard this once the a crisis. As federal average to exchange an enthusiastic Cooling and heating unit places during the to $8,000 , Cooling and heating repair can cost you are different according to facts plus it is generally helpful to think taking multiple prices.

Busted window otherwise doors

In case there are a storm otherwise an accident, it’s also possible to sense busted window or doorways. A reduced entry in the household would be to typically end up being fixed as quickly as possible, and rate is determined by what kind of windows or home you really have. The brand new repair in itself will be between one or two hundred so you can one or two thousand cash.

Water damage and mold

If you reside yet another Flooding Threat City (SFHA), the water pipes bust or a lot from washing went faulty, of numerous homeowners handle water damage and mold will eventually. Occasionally, it can be as simple as drying off of the counters or substitution a carpet. Other times, water damage you can expect to need thorough solutions, since the water-can trigger mold or other structural damage. According to National Ton Insurance System (NFIP), the average ton insurance coverage allege commission into the 2020 was $52,000, because mediocre price of ton wreck to have residents instead of flood insurance policies is $107,000.

Pest infestations

Cockroaches, bedbugs, termites, bots and other creepy bots may such as your family just as very much like your. Depending on where you live, this may be a major matter. If you happen to find yourself with an infestation, you might have to hire an exterminator to assist mitigate the fresh new thing. Discover insect-handle functions that offer you to definitely-day providers typically on the hundreds of dollars, although some promote ongoing qualities to own a fee every month. According to National Pest Government Connection, termites alone lead to more $5 million for the possessions wreck annually, a fees perhaps not included in really homeowners insurance arrangements.

Ideas on how to buy domestic fixes

Essentially, investing in home solutions is protected by your home insurance (depending on the disaster) otherwise away from an individual savings account when your policy would not safeguards them. Given that solutions is going to be pricey, a personal bank account will come in helpful, but there are many more options to imagine.

Here are some different ways to cover family fixes if you’d https://cashadvanceamerica.net/loans/tribal-installment-loans/ like after that guidelines covering the price of a crisis:

Household guarantee mortgage

Household Security Funds otherwise a property Guarantee Credit line can get be studied having domestic repairs or renovation that will end up being a great sweet perk of home ownership from inside the a crisis fix circumstance, as the you may be credit contrary to the collateral you’ve gathered in your domestic. They may provide all the way down interest rates than the other designs from borrowing, such as unsecured loans. Create mention, but not, that your home may serve as security if you fail to repay your loan and that Chase doesn’t currently bring this type off home loan.

Crisis financing

Crisis fund are like individual coupons levels but they are instead booked getting points for example a crisis household repair. If you have an emergency loans membership and it also outweighs almost every other solutions, this may be an enjoyable experience so you’re able to make use of they. If you don’t have an urgent situation money, don’t get worried, there are many more alternatives.

Regulators fund or grants

There are numerous authorities programs intended to help home owners with high priced domestic maintenance. For example, brand new Restore system [Residential Crisis Qualities to offer (Home) Solutions into the Elderly] even offers help senior citizen home owners old sixty and over. This choice was created to help elderly people into the cost of handling issues and you will password violations you to definitely twist a danger to their safe practices otherwise affect the livability of the household.

Support out of relatives and buddies

When you’re writing about a genuine crisis, envision contacting relatives otherwise friends to find out if people of them could offer financing. Preserving your home safer is very important, and you can provides people prepared to assistance with the price of resolve.

Personal bank loan

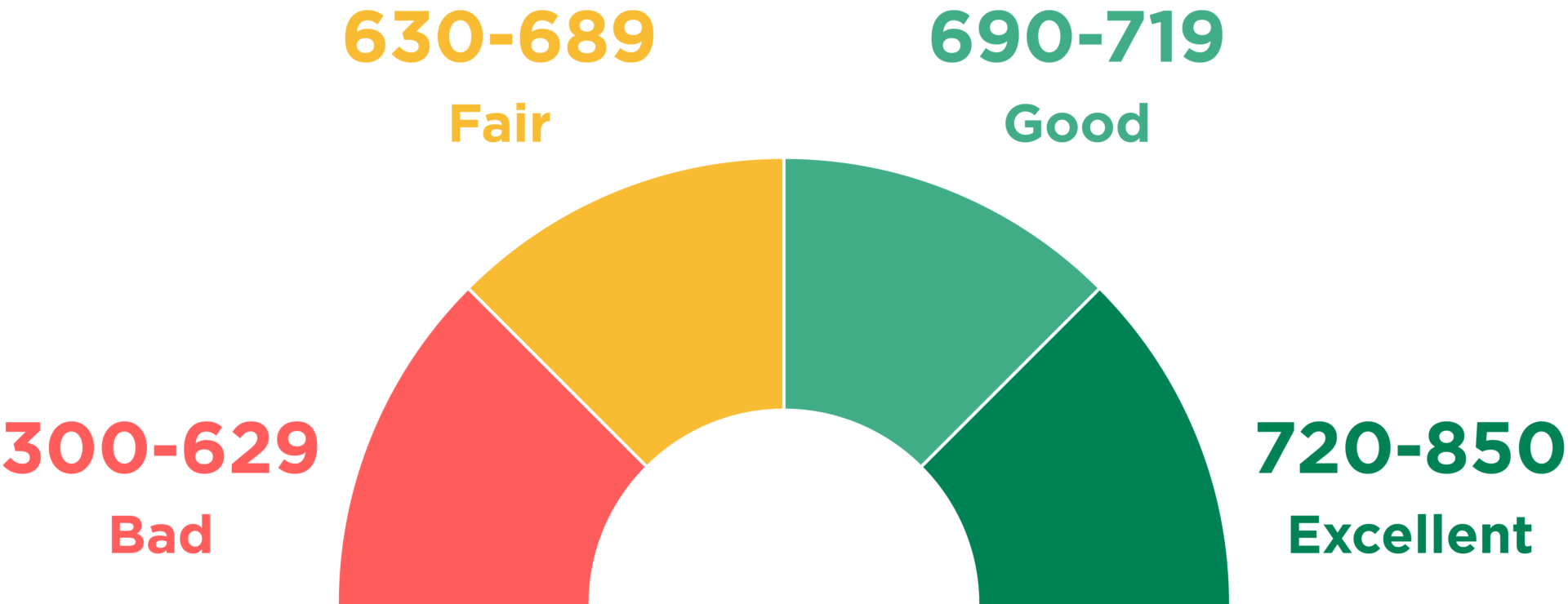

A personal bank loan is an unsecured loan that doesn’t wanted guarantee. Signature loans can be used to satisfy unforeseen costs and can even be used to cover your own emergency house repair. Manage keep in mind that new terms of a personal bank loan trust the newest borrower’s creditworthiness. If you can’t pay-off a personal loan, you may get large appeal payments that build more time.

The bottom line is

Given that a citizen, emergency family fixes usually are inevitable. Luckily there are many different options available to help you coverage the expense of family solutions and continue maintaining your house secure. Always think about the benefits and drawbacks of each means and you will how it might apply at your current financial fitness before making a decision towards the road that’s right for your requirements.

Comentarios recientes