SECU suits traditional, jumbo, changeable and repaired rates finance, however FHA and you will Va funds. SECU also offers unique mortgage loans to own historical residential https://paydayloanalabama.com/uriah/ property, money features, and are created residential property. The financing partnership possess basic-date homebuyer software with generous closing costs direction. SECU prioritizes openness from inside the prices and you can charge. not, constraints occur as the SECU only operates from inside the find says and you may registration is limited to certain groups.

In today’s actually-switching real estate markets, borrowing from the bank unions including SECU are coming submit that have a great smorgasbord away from varied home loan selection one distinctively personalize to their members’ requires. Heard of a mortgage to have a historical house? Think about one having a produced domestic? From the SECU, eg financing brands can be found in an effective day’s-work.

Breaking down SECU’s Mortgage Choices

SECU has generated by itself since a-one-stop-look for all kinds of home loan brands. Yes, even right down to a great jumbo financing, that is essentially a home loan to own an expense you to is higher than this new compliant financing limitations set because of the federal property fund bodies.

As they usually do not amuse FHA and you will Va fund, they prosper for the taking antique financing, mortgage refinancing, changeable price and you can fixed rate money, and others. This gives professionals a vast palette out of financial options to like from, ensuring that there is something for everyone.

Commitment to Specific niche Homebuyers

SECU exclusively supplements their thorough home loan offerings having special programs to own different varieties of belongings. This includes specialty mortgage loans having are built land, historic property, and also resource functions. Just how fun will it be having some history? If you desire to and get a historic house within the jurisdiction of the New york Historic Preservation People otherwise a community Historical Preservation Panel, SECU ‘s got you shielded! Appreciate a created family rather? No problem, SECU has the benefit of single-and twice-wide are available lenders with a maximum label out of fifteen years.

Good Help getting Very first-Day Homebuyers

Entering the homebuying globe the very first time would be overwhelmingly overwhelming. Navigating the fresh cutting-edge slang, skills rates, and completing paperwork feels as though against a formidable monster. But there’s a slice of delighted reports! SECU now offers an application intended to support the hands out of basic-date homebuyers, at the rear of them from the procedure when you are enabling all of them deal with closing costs expenses. Qualified users you’ll qualify for to $dos,000 to summarize cost assistance!

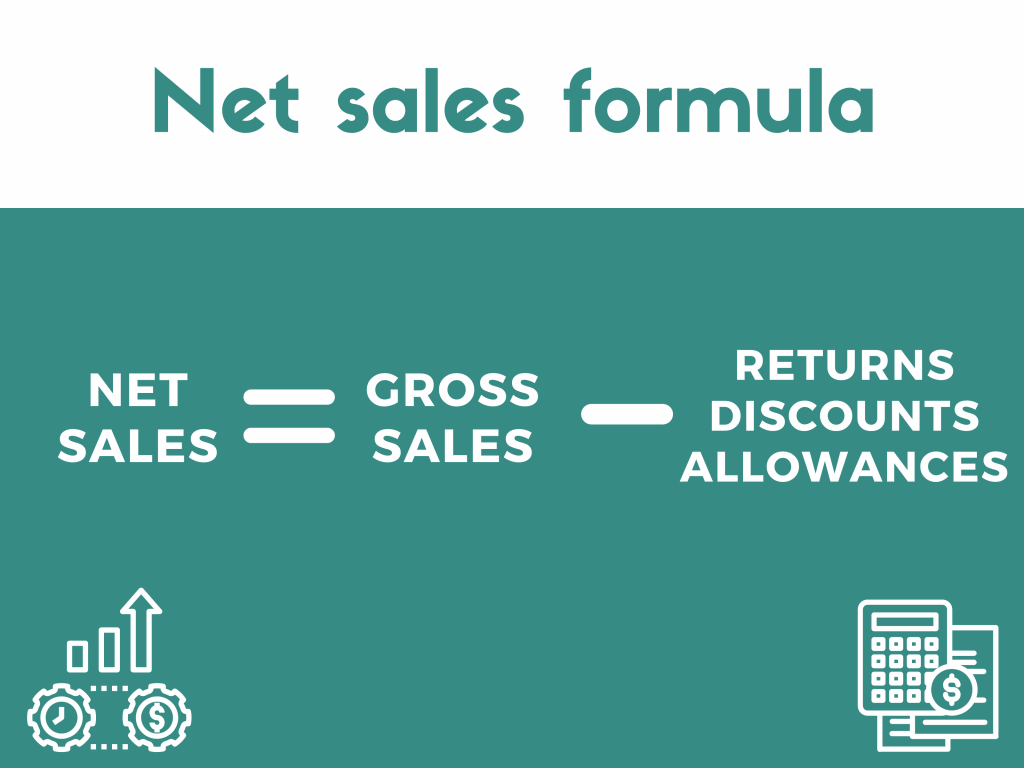

Clear Pricing and you will Costs

Whenever walking from the loan procedure, actually they comforting whenever a loan provider was upfront in the its charges and rates? SECU have nailed so it quality by being completely clear regarding the financial costs and you can fees. Which ensures you have all the info initial and certainly will build advised choices one make together with your monetary capability.

While you are SECU’s offerings have a look attractive, they show up making use of their great amount regarding shortcomings. Even the very true is their shortage of government-backed financing. Including, the financing partnership selectively operates within the certain states, plus Georgia, New york, Sc, Tennessee, otherwise Virginia. This really is a strike to people who wish to purchase qualities beyond these claims. Likewise, SECU’s membership is bound to particular group communities instance New york state team, federal personnel assigned to Vermont state companies, staff from North carolina societal forums regarding training, members of the new New york National Guard, etcetera.

Sure, SECU’s financial offerings is thorough and you may tailored to complement diverse requires. However,, always keep in mind which they include limitations. For many who fulfill the criteria and you may inhabit one of several claims they work in, you can make more of their vast home loan possibilities collectively using their unparalleled service to possess first-day customers. Although not, the registration standards and you will absence of bodies-supported financing is generally quite restricting for other individuals.

SECU mortgages are not for each and every homebuyer out there, but also for those who normally avail them, he is a new blend of greater-starting options, openness, and you can strong support for basic-big date customers. When it aligns along with your means, then maybe a beneficial SECU financial awaits your on the other side of your own rainbow!

Comentarios recientes