Enabling those who help us: The importance of specialized lenders help our registered nurses, certified paramedics, and you will law enforcement officers.

Within people, extremely important services professionals including inserted nurses, paramedics, and you may cops play a serious part in keeping that which you powering efficiently. It seems like everyday he or she is fighting to possess identification, service, and you will reasonable remuneration-stuff you do imagine it won’t need certainly to battle to have. This type of everyday heroes purchase their existence in order to offering the community. From the FinancePath, we think in the giving back into those who render really to help you all of us.

The key benefits of this has actually usually already been arranged to have doctors, lawyers, and you can accounting firms, however, we feel our essential qualities gurus need a reasonable go as well.

We try to make the mortgage process due to the fact smooth and you will of use you could, guaranteeing obtain a knowledgeable care

No Loan providers Mortgage Insurance coverage (LMI) is frequently booked towards upper end away from town. Joined nurses, paramedics, and you can police officers may now make the most of which have which fee waived because of the extremely characteristics of the operate. Toward a great $500,000 mortgage, this may help save you a primary cost of doing $ten,000 in addition to most of the accumulated appeal this will rates across the life of the loan.

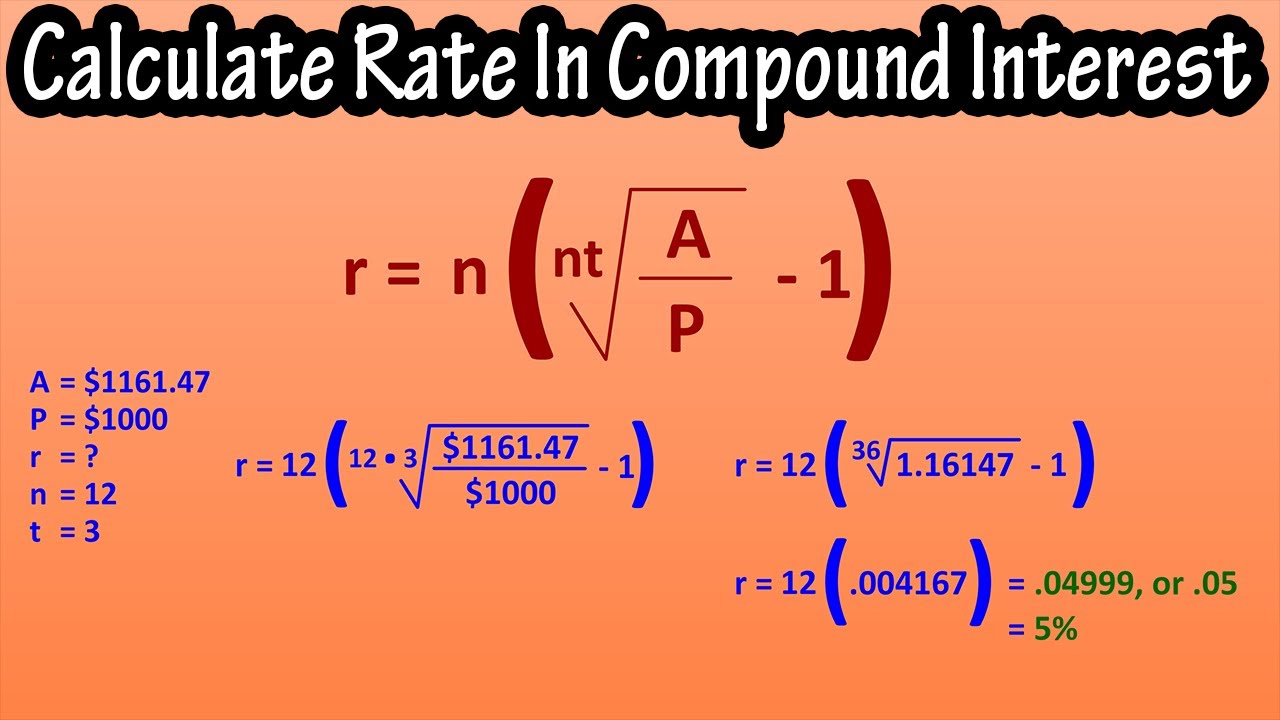

To understand this new savings best, imagine a beneficial $10,000 LMI commission within mortgage loan off 6% more than thirty years. The interest about this count manage incorporate tall will set you back. Let us crack they down:

- LMI Rates: $ten,000

- Interest rate: 6%

- Financing Term: thirty years

It indicates you can save yourself almost $57, altogether by the without to spend this new LMI and its own relevant attention.

This is why we’re thrilled to give them probably the most Services Package to have lenders

- Zero Lenders Financial Insurance policies (LMI) for up to 90% Mortgage so you’re able to Really worth Proportion (LVR): To quit purchasing Loan providers Financial Insurance policies (LMI), you generally have to have an excellent 20% put, gives you that loan so you can Worth Ratio (LVR) from 80%. Using this type of plan, you might use around ninety% LVR and we will waive the latest LMI percentage, making it simpler and reasonable to view your new home.

- All the way down Rates of interest: That one even offers aggressive interest levels which might be usually less than basic pricing. Although you happen to be borrowing more 80% LVR, you are considering a discounted interest for your home otherwise financial support loan. The maximum lent matter is 90% LVR. This helps get rid of monthly mortgage repayments, and come up with homeownership so much more in balance into the a fixed income.

- Versatile Fees Solutions: Knowing the demands from extremely important provider roles, we offer versatile payment choices to accommodate differing schedules and you may monetary issues. This includes options for a week, fortnightly, otherwise monthly payments.

- Shorter Costs: To relieve the fresh economic burden, our very own bundle boasts reduced otherwise waived costs having application, control, and ongoing account repairs. This means significantly more discounts to you.

- Customised Support: We out of faithful lenders knows exclusive requires away from very important provider specialists. We offer customised advice and you can complete currency administration agreements designed to your specific disease.

At the FinancePath, i recognise the difficult work and you may time and effort off registered nurses, paramedics, and you can law enforcement officers. Our very own Extremely important Functions Package is more than simply an economic device; its a connection so you can supporting the people that help our very own organizations.

Supporting people who help us is not only an effective tagline; it’s a philosophy loans Pennington AL i live because of the in the FinancePath. The essential Qualities Bundle was a testament to your commitment to crucial specialists. The audience is here so you’re able to achieve your dream of homeownership when you’re providing the capital and independence you would like.

When you are a registered nurse, a fully qualified paramedic, or a pledged-in county otherwise federal police officer thinking of buying a home, contact us right now to find out more about the essential Characteristics Bundle.

Comentarios recientes