It all depends for the style of loans and you may your location. Mortgage loans and you may automotive loans is actually handled in a different way than personal credit card debt and you will college loans. Examining and you can coupons membership are handled differently from coverage and you can senior years levels because the parts of the entire property, and collectors will probably expose on their own easily. So, stopping financial obligation for the heirs to cope with is important.

Basic, it helps to know about the procedure of paying down your financial factors. The new property someone has actually during the death are called the new house, and you will the costs brand new dead discontinued must be repaid until the heirs receives a commission, something get encompass probate court.

How Probate Courtroom Really works

Probate ‘s the courtroom techniques getting installing the latest validity of a great commonly, choosing the latest lifeless man or woman’s possessions and you may using condition laws so you’re able to posting men and women possessions in order to heirs, creditors and, if there is taxes, the federal government.

After demise, an executor could be put in charge to find, protecting and you may managing the estate’s assets. When you have a may, it should name whom you chosen regarding part. If there is no usually, the latest probate courtroom appoints a professional. The newest member brings a list of their property, debts and you may that is so you can inherit the newest estate. That require components of brand new property being sold in order to make the bucks necessary to pay loan providers immediately after which heirs.

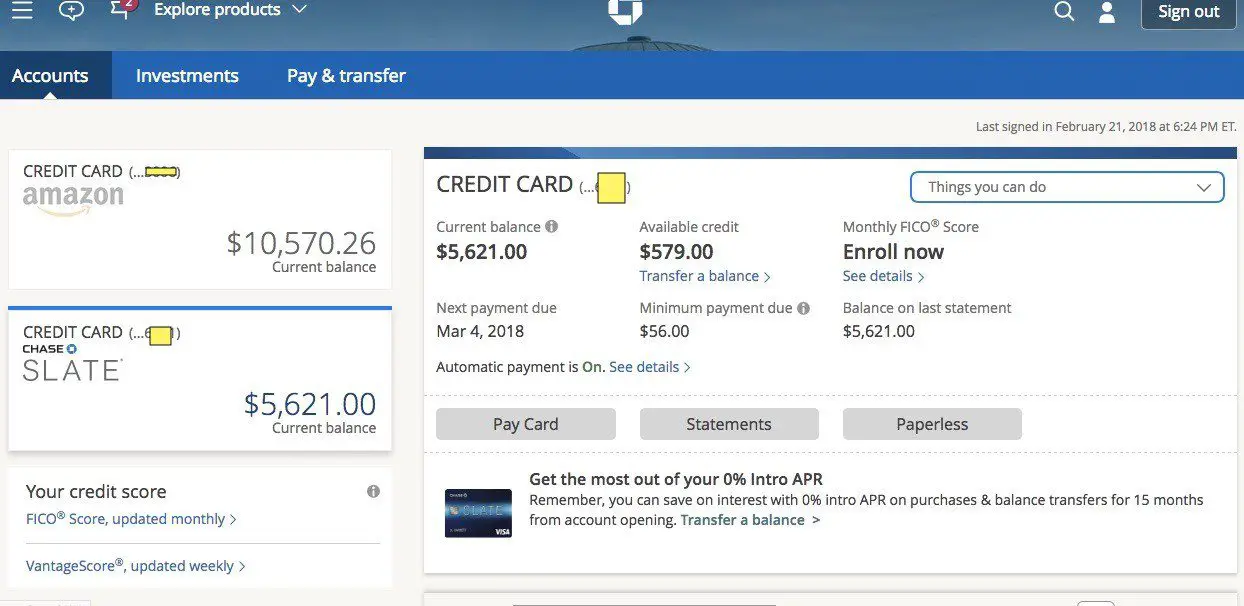

First, the fresh executor need certainly to know if the brand new house possess enough money to pay all their bills and you will debts. The fresh new Alaska instant funding property include offers, possessions, uncollected loans owed into inactive, finally paychecks, life insurance repayments and you will old-age membership. Certain possessions may need to feel appraised. At exactly the same time, debts are reviewed, together with, mortgages, credit lines, taxes, money, electric bills, mobile phone expense and credit card bills. In case your estate provides even more debts than just possessions, it is insolvent, and you may federal and state laws and regulations decide how so you’re able to split the cash and and that financial institutions get partial money.

Note: For those who co-finalized that loan into the dead, you to definitely loans falls under your, perhaps not brand new property, therefore have to pay it back.

When the property continue to be shortly after expense and you will taxes is actually repaid, the fresh new property score separated according to the have a tendency to. When there is no have a tendency to, new court you will supervise the new distribution out of assets to settle disputes one of the heirs.

Is Creditors Follow the entire Property?

Typically, zero. And in case the new accounts got a designated recipient aside from brand new deceased man or woman’s home during the time of dying, life insurance policies and payouts regarding IRAs, 401ks and other senior years accounts try secure. If, not, living insurance coverage beneficiary was deceased, you to work for may likely enter the estate and you can paid off so you can creditors. If the designated recipient had passed away, the brand new later years accounts could possibly get solution towards heirs-in-laws when the those individuals are the terms of the new account’s payment regulations.

Imagine if the brand new Deceased Had home financing and you can/otherwise Car finance?

If you inherit a home who may have home financing, government rules claims the lending company cannot lead you to spend they off instantaneously if you remain putting some money. If there’s a property equity loan to the possessions, the lending company can push new inheritor to repay instantaneously, however it is more likely lenders usually let the inheritor to only dominate money.

When it is an auto loan, you will probably need to get the auto transferred to the title and refinance the mortgage to save and then make payments.

What goes on so you can Credit card debt Once you Die?

Usually, credit debt after death need to be paid by house. During the nine says, the responsibility drops with the enduring partners. Arizona, California, Idaho, Louisiana, Las vegas, The fresh Mexico, Tx, Washington and you will Wisconsin was area assets states, that makes thriving partners guilty of one personal debt incurred from inside the e was not for the membership.

Comentarios recientes